The US rental market is an interesting and dynamic market. It is driven by so many factors such as population demographics and economic performance. Where is it today and more importantly, where is it heading?

1. US Rents hit an all-time high

Average rents across the US increased to an average of $1,400. How widespread was the increase? Rents increased in 88% of the largest 250 cities in the US. Average rents decreased in only 2%. That’s 5 cities. I would be hard pressed to name 20 of the nation’s largest cities–but 250?!

The report goes on to explain that the increase in June was fairly balanced across all housing sizes. Through 2018, most of the increases was due to 2 and 3 bedroom rentals. This is because renting is increasingly popular among small families (likely because owning is still out of reach for many in high demand housing markets).

2. Progress Residential is betting big on Single Family Homes

This is likely related to the point above about home ownership being out of reach for many young families. National Real Estate Investor reports that the demand for single family homes is driven by financially stable young adults who are locked out of the housing market.

The fund is actually managed by Pretium Partners, but the day to day management and operations will be handled by Progress Residential. Progress has already purchased 5,000 new homes using the fund.

3. Puerto Rico appears to be the next big investment opportunity

Puerto Rico is still suffering from the damages wrought by Hurricane Maria. Not only have home prices dropped 15% after the storm, but there has been a long running trend of decreased home value. Since 2010, median home prices have dropped 48% (today they hover around $117k). Even before the storm, roughly 1/6th of the island’s mortgages were facing foreclosure (this is comparable to the US at the height of the mortgage crisis in 2010).

It looks like now is a good time to buy in Puerto Rico, as long as you have a way to handle the renovations and repairs required to bring the home into a rentable state.

BONUS FACT: Forecasting Demographic Changes

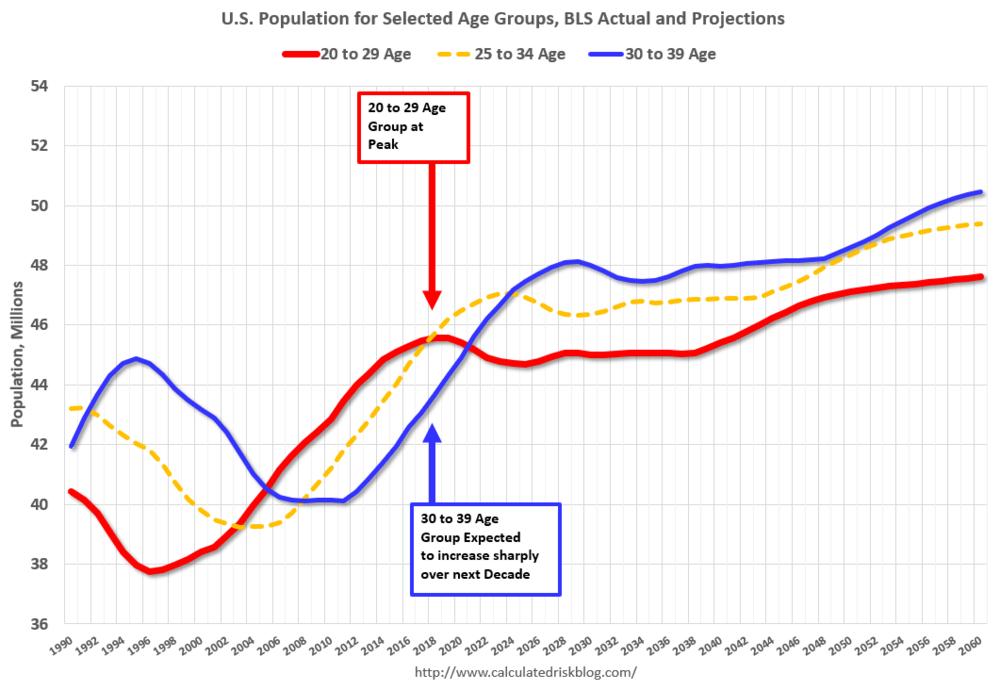

The prime renting age group is ages 20-29. This group, not only as a percentage of the overall population, but in terms of overall numbers, is expected to peak in 2018. Yup, that’s right now. That means this year’s all-time high in rents is entirely expected due to demographic factors alone.

Over the next 10 years, the 30-39 age group is sharply increasing, which should spur more home purchases and contribute to a softening rental market. This is just one factor of many, but also suggests Progress Residentials investment in single family homes is a shrewd decision: rental rates may not increase much further, but home purchases are expected to grow in the long term.