Home sales company Redfin looked at migration from high-cost metro regions to cheaper markets. The Dallas region was on the top 10 list of U.S. cities where residents are going to find cheaper housing and living expenses, researchers with the residential brokerage company discovered. The largest share of newcomers to Dallas was from Los Angeles. Redfin stated that nearly a quarter of its own house searches in the Dallas area were people moving to the area.

A quarter of Redfin’s clients in the third quarter were moving into various metro areas. “Rising mortgage rates have been exacerbating affordability problems which have been driving people from expensive coastal metros for the last few decades,” Redfin chief economist Daryl Fairweather stated in the report. “With [interest] rates no more near historical lows, buyers are becoming more and more cost-conscious, seeking cheaper homes in low-tax nations in the South and centre of the nation.”

The cities visiting the most moveouts include New York, Washington, D.C. and Denver. In these markets, more people were seeking to leave compared with the amount of individuals seeking to move in. “The metro regions seeing the largest inflows of new residents are the large cities where housing prices are still relatively inexpensive and job markets are powerful,” Redfin researcher stated. With the median home price still marginally below the national average, Dallas-Fort Worth is still one of the most inexpensive big-city housing markets. And, despite home prices going up by over 40 percent over the previous five decades, D-FW home costs continue to be well below what buyers pay in most coastal markets. With employment growth this year of over 100,000 jobs, the D-FW area continues to attract thousands of people annually.

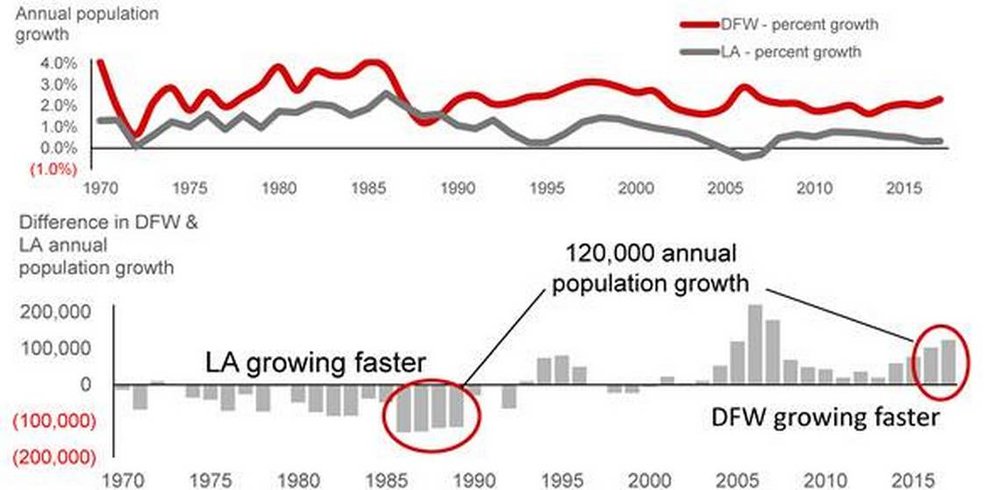

JLL, a global real estate investment firm with a strong presence in North Texas, reached that conclusion after analyzing population trends going back about five years.

The trend indicates a boon for building industries, who probably will remain busy building homes, businesses, roads and other infrastructure to satisfy demand. But it also may pose another concern for people who are already worried about growing traffic congestion andrising housing prices in the Metroplex.

JLL’s research started after a recent, off-the-cuff remark by a speaker at a gathering of Dallas-area business leaders.

“In a new regional area lunch, the question came up as to what other markets saw the sort of population growth we’re now seeing. The off-the-cuff response was — perhaps LA in the 1980s,” Walter Bialas, JLL vice president and manager of research, wrote in his report. “Turns out, that was right — but it’s a bit more complicated.”