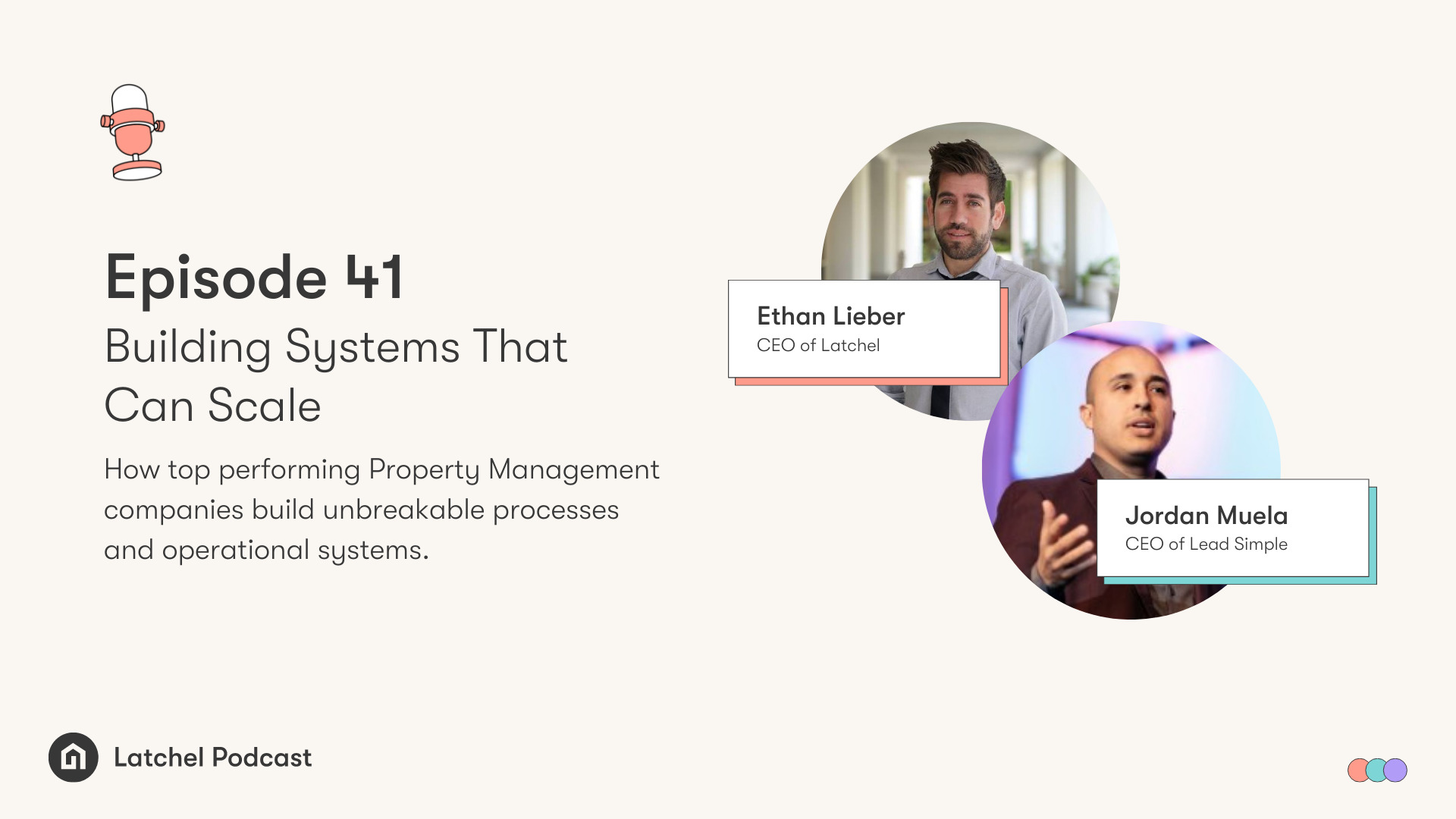

Scaling Systems: How Property Management Growth

- If your company were to double in size tomorrow, what in your processes would break?

- What’s the best way to build systems today that will support future scalability?

- What core traits do some of the most successful Property Management companies have in common?

We dug into these questions and more with Jordan Muela – CEO of Lead Simple, Cofounder of Profit Coach, and host of the Profitable Property Management Podcast.

Tune in below to take the deep dive with us. Get your notepad ready, this one is full of rich and actionable value sure to motivate and inspire the path to growth.

Listen In:

Watch the Live Recording:

Read the Full Transcript:

Ethan Lieber:

So, maybe you could start us off. Give our listeners a little bit of background about you, and maybe just start with that elevator pitch of LeadSimple and what you guys focus on for PM companies.

Jordan Muela:

So, for the longest time, LeadSimple has been focused on solving sales and marketing challenges and helping companies operationalize sales marketing. They tend to be ops focused and really have very little process and structure around the sales and marketing functions. And we help build that process, help automate streamline that process, but there’s more discipline on the sales and marketing side of the business.

Jordan Muela:

As of about two years ago, we pivoted into workflow operational processes. So, after you close a new deal and you close the business, you can onboard the owner, onboard the property, begin the process of doing lease up, et cetera. All of that stuff can now be done inside of LeadSimple. And so, we’re full steam ahead on workflow automation.

Ethan Lieber:

How did you know this was a problem? How did you even get into this?

Jordan Muela:

I always follow the problem. I care more about the problem than the solution that started off when we were doing lead gen in the industry. I did that for about two years. Got out of it because I didn’t like the search volatility associated with lead gen. But we were sending people own our leads and they would say, “The leads are no good. The leads are no good.”

Jordan Muela:

We did some research. We realized that on average, people were taking about 48 hours to call a new lead back, following up 1.5 times. And so, there was a problem. So, we chose to make it our business to help them close the deals. Therefore, we built LeadSimple, did that for a while.

Jordan Muela:

Realized that a lot of folks didn’t have a framework or concept for sales marketing, so we started an event like PM Grow. Realized you could grow and not make any money, so we started ProfitCoach. It’s always just following the problem for me.

Ethan Lieber:

This is maybe not on track with just a linear progression of how you got into this and how your career has spanned, but maybe you can give us a quick example just to solidify this in our listeners minds of, there are already management companies.

Ethan Lieber:

And they’re probably sitting there thinking, “Okay, I get it, the process of getting an owner interested and bringing them through the sale, and then onboarding them, yeah, to this process. But how is LeadSimple actually going to help me with that? How are the different process things you guys do even going to matter?” [crosstalk 00:03:34]

Jordan Muela:

I’d say the first thing is just it is helping you get clear on what the process should be. So, we’re not trying to cram technology. But I think what technology is or writing software, it’s like using concrete or cement. It’s really good if that is where the cement of the concrete should go. And it’s horrific if that wasn’t where it was intended to go.

Jordan Muela:

So, the first thing we do is have a broad conversation about your systems, about your processes. The fact that we’re working with hundreds of companies to do this gives us a pretty high-level view of thinking about system design, about having a conversation with you about where you’re at, where your staff is at, relative to thinking as system design people, and then how that shows up and how your existing processes function today, having the conversation to optimize that.

Jordan Muela:

Once we’re on the same page about what’s going to be best, what’s going to drive throughput, what’s going to drive the organizational operational outcomes you want, they’re typically related to throughput, error reduction, revenue improvement, et cetera, then the tech comes in and streamlines. And that’s where we codify those best practices.

Ethan Lieber:

Are there certain indicators that a property manager could look at to know that, “Hey, now would be the right time for me to go talk to Jordan.”?

Jordan Muela:

I think the general indicator would be that you’re feeling a real tension between wanting to grow, but knowing in your gut that things are going to start blowing up, that there’s some real fragility. And there’s just a sense that there are unforced errors happening in the business, that if you were there and if you could clone yourself and there was 10 of you wouldn’t happen.

Jordan Muela:

But given that that’s not realistic, the next best thing is to put your likeness through your thinking codified in systems and process. And when that isn’t there, it’s a tough row to hoe. So, you got to step back and make the time.

Ethan Lieber:

I feel like there’s maybe two parts to this, right, which is you can use the question. And I’ve used this before at NARPM conferences and things like that, where I’ll ask folks, if your business doubled tomorrow, if nothing else changes, but all of the sudden, tomorrow, you have twice as many doors you’re managing, what in your business breaks?

Ethan Lieber:

I find that question can sometimes… the gear is working. The first half of it would be even, how do you even make it feasible for me to double my door account? Do you guys tackle both problems?

Jordan Muela:

Yeah, we do focus on both problems. As you say that, what comes to mind for me is that it’s easy to go down to, well, leasing would break, maintenance would break. What I find systemically is that most things that would break are its people related because it is people. It’s like a bunch of bodies glued together.

Jordan Muela:

The metaphor that comes to mind for me is that when you’re trying to move faster, you have a load behind you, think of your business as a tractor, it’s trying to carry load, you want to add more load, you want to pull even more. And so, in your pursuit of forward movement, you could improve the horsepower of the tractor, or you can add people in front of the tractor to pull the tractor like sled dogs.

Jordan Muela:

Most people as they expand capacity are doing so through brute force, as opposed to getting the leverage that can happen with systems and technology. So, as you put more load on the system, the things that tend to break are very much the people-related stuff, where the minds simply cannot expand to deal with the expanding complexity.

Jordan Muela:

That’s the metaphor for me is, the idea that a small business is a scaled-down version of a large business is the fundamental error that most business operators make. On my bigger business, my 300-unit business at 3000 units will just be proportionately larger, as opposed to saying it will be dramatically exponentially more complicated. And if I’m currently making my current level of investments in infrastructure, that level of investment won’t scale. Does that make sense? You follow me?

Ethan Lieber:

Yeah, I think so. The way I’m hearing you is, let’s say you’re operating a hundred doors. You’re probably operating in a pretty scrappy way. You might not even need processes around certain things. It’s a lot of grit. I was just talking to someone earlier today. I’m like, “Man, property management, you have to be top 95th percentile of grit to be able to do property management, especially at that stage.” Right?

Ethan Lieber:

So, you’re hustling, you’re pushing things forward, you’re brute forcing a lot. And that if you think about growing to, say, a thousand units, and you think of it as just like, oh, you’re just proportionally increasing everything, that things start falling apart because you can’t run a thousand unit with the entrepreneur’s grit alone.

Ethan Lieber:

You can with a hundred, but you can’t with a thousand. And that means processes need to change the mental models behind how you do certain pieces of work need to change. And they need to become more systematized, right?

Jordan Muela:

Yeah, absolutely. I think there’s a weird dichotomy here. And I think you’re one of the people that will get this more than most. At a hundred units, in a weird way, you’re embracing maybe the peak level of complexity that you ever hoped to do. So, the level of complexity when I have no systems, no process, I’m just accessing the mind of the single person where every department is in my brain, it’s insane levels of complexity that would never scale.

Jordan Muela:

So, to scale, you have to do two things. You have to streamline. You have to get rid of edge cases. You have to use policy to make simple framework-based decisions. Process is not a substitute for policy.

Jordan Muela:

And you’re the guy that can comment on this because one of the things I’ve always found interesting about your offering and the space that you’ve played in is that maintenance is intrinsically so difficult. It’s easy to take potshots when things don’t go wrong, but what I find with maintenance in particular is that maintenance is not a monolith.

Jordan Muela:

And if you treat it as such, you will fail. I.e., if you try to send or outsource all of your maintenance stuff without any consideration of the different types of maintenance work, some of which lend themselves well to be outsourced, and others you knew that that crazy insane complex task wasn’t likely to get done well, that’s an example of the nuance that has to be appreciated with it.

Ethan Lieber:

Yeah, that’s exactly right. I think the reason maintenance scares a lot of companies away from engaging in, and it can be the most difficult thing a manager tries to figure out as they’re building processes. There’s such a variety. There’s such a wide scope.

Ethan Lieber:

We were breaking down customer profiles yesterday. These are the Latchel customer profiles we’re breaking down. And there’s just from the top-level combinations of policy with how maintenance is handled, you end up with over 48 different process combinations. And this is just for the most basic forms of maintenance policy.

Ethan Lieber:

Now, the crazy thing is… and I’m sure you do a lot of work with managers that are at a hundred doors, maybe even 50 doors looking to scale up to a few hundred or thousands, where you’re an entrepreneur and you’re struggling. You’re bringing in companies. You’re taking every lead you can get. You’re closing the best you can.

Ethan Lieber:

And fast forward six months, you’ve got a hundred doors with 300 different policies based on the unique door and you’re like, “How do you go the company around that?” So, how do you work with these types of smaller companies that are growth minded? They want to go from 50 doors to a thousand. How do you get in there and help them build this policy? Because that sounds like a lot more than just software.

Jordan Muela:

Yeah, it totally is. I’d say the dichotomy here is that the human mind, the human will, requires a certain level of delusion in order to get in the game, right? If you knew how hard it was going to be at the outside, you wouldn’t have done it, at least that’s my experience.

Jordan Muela:

And so frequently, people do things that won’t scale in order to get a hundred, 200 units. And at some point along the way, they get stuck. I’ll talk to people that 300 units, and they’re like, “I don’t know how to grow my business.” And my question is, well, how do you get the first 300 doors?

Jordan Muela:

The answer is, I did things that I’m no longer willing to do. I did some scrappy, ugly stuff. And I would prefer not to do that. I’m busy. I can’t do that. And furthermore, I’m dealing with the… what do we call this? There’s an analogue to technical debt.

Jordan Muela:

You know what technical debt is. It’s this organizational debt that is derivative of my previous low-quality decisions, particularly with policy. I took on a bunch of crap units. I don’t make any money on a lot of them, which means they take my capacity, but I get no yield. I get no cash flow to improve the quality of my services. So, people get stuck.

Jordan Muela:

And there’s a natural reset around 200, 300 units. And it keeps happening, where you got to scrub the barnacles off. You got to get rid of the bottom tier of class C owners, class C properties. You got to do some fee maxing. So, there’s a natural ebb and flow. And I think that’s just a part of business.

Ethan Lieber:

Yeah, that makes sense. I think that as you’re scaling up too and you have these different shot points, you start becoming a different kind of company too. I think along with that comes the adoption of not only different policies, but probably different technologies.

Ethan Lieber:

I’m curious in your perspective too on what happened with Coronavirus and everything going virtual. It seems like there is this huge adoption of technology platforms and property management and other parts of real estate, like proptech in general. It’s exploding. I think if you look at some of the VC funding that Latchel included in here over the last two years, it’s exploded for proptech.

Ethan Lieber:

I’m curious, has that changed what you’re seeing happen among property managers looking to grow? Are there different forms of technology they’re adopting? And how does LeadSimple play into that?

Jordan Muela:

So, my fundamental vision here is that we’re seeing maybe three distinct epochs of property management. One was totally old school, the paper world. That is really largely been killed. The second-generation wave was technology to enhance and extend the way business has already been done, and then a third way of transforming the way that the work is actually done.

Jordan Muela:

And I think the best way to reference this is technology solutions that are helpful and useful but just complicated enough for a certain class of the owners, business owners or team members, to see the potential, but they’re intimidated because their identity informs them that that shouldn’t be their job.

Jordan Muela:

The real work of property management is over here. I’m being asked to learn this technology, and I’m not quite there. I haven’t shifted my identity to believe that building the rails upon which the work flows in a digital first manner is my actual job. People coming into the business now that will be ramped up five to 10 years from now, I believe that will be inverted. And I believe that will be the norm.

Jordan Muela:

So, we’re talking about a no code, low code paradigm. We’re not talking about programming, but we’re talking about stitching different tools together to build those workflows. And again, just the rails of how the workplace with the organization is supposed to focusing on individual tasks primarily.

Ethan Lieber:

I’m glad you talked about this difference between the property managers’ identity and how the job itself has to be different for the property managers to seek going forward. I think the old school way to look at this is just a few years ago.

Ethan Lieber:

When we started Latchel, talking to a ton of property managers, a lot of property manager said, “Well, why would I have any automation or workflows with maintenance? My job is maintenance.”, to which the response is, “Really? The property manager’s job is maintenance coordination?” That sounds like a job of a maintenance coordinator, not a property manager. Whose job is it to increase the value of the asset?

Ethan Lieber:

And a lot of property managers would say, “My job have increase in value of the asset, so my owners are making more money every month. And the property investors I work with are going to sell that home at higher value, or whatever.” Right?

Ethan Lieber:

And thinking about property managers that want to scale, they want to grow, they want to be forward looking, they want to build high value, what do you think they should be looking at their job is? What is the right job of the property manager?

Jordan Muela:

Wow, man, you have a deep one there. I fundamentally agree and believe with what you said previously, that is to say that there is a hierarchy. There’s a ladder of volume. And the lower you sit, the more of a commodity you are. And you know how much of a commodity you are based on what your sales conversations look like.

Jordan Muela:

If you find yourself in a constant bitch and complain that people only want to talk to you about price or only want you to ask me menial things, who don’t appreciate what you do, if you want to know why it’s happening, look in the mirror. The positioning, the conversation that you are entertaining is derivative of and feeds into how people view you.

Jordan Muela:

So, I know in my business, for example, I could talk about the technology. It’s cool. It’s interesting. It’s great tech. That is not the highest and best conversational use of my time. I would rather have a conversation that addresses the deepest felt needs of my customers and let things flow down to the logical implications around technology, same thing for property managers.

Jordan Muela:

So, talking about it in terms of being an asset, addressing people as an investor rather than an owner, talking about a resident instead of a tenant, there’s a way to elevate the conversation to align to and get curious about the deepest felt need of your customers.

Jordan Muela:

And people push back and they say, “But Jordan, they’re not investors. They’re accidental. I’m in California. They’re never going to buy more than one property.” But maybe that’s just a story you’re telling yourself because you’re not interested in accruing the skills and going through the necessary work to facilitate that bigger conversation. And if not, my biggest question is, why?

Jordan Muela:

I don’t know about you, Ethan. But what gives me stamina in my work being in my late 30s is it’s not Red Bull anymore. That’s not cutting it. I need to have some meaning in my work. And so, the quality, the depth of my conversation, which is related to the significance of the outcome that I’m trying to facilitate, that gives me stamina. That takes me to a place of creativity.

Jordan Muela:

So, I don’t know why anybody wouldn’t do that if they have the choice and the option to do so. And I believe that the vast majority of property managers do. And if you’re not capable of doing that, it’s a slog, man. It’s a slog to know you’re a commodity and to just have better systems and better sales and marketing. You can layer those things on top of selling a commodity, but that’s headwinds instead of tailwinds in my experience.

Ethan Lieber:

All right. Are there certain competitive advantages your customers have that are feeling their growth?

Jordan Muela:

Definitely. I think broadly speaking, the advantages that my customers have and those that are in earshot of me is a greater orientation on the unit economics, the strength of the business, not only as it relates to the benefit for them, but the benefit that it creates for the customer.

Jordan Muela:

And the stronger that your business model is, the more value you’re capable of creating and the more value that you’re capable of capturing. Now, if you want to take it lower than that, having a streamline operationalize sales and marketing function. When you understand sales and marketing, it’s a distinct skill set. It has nothing to do with property management.

Jordan Muela:

I mean, there’s some level, something in the middle of the Venn diagram. For the most part, it is a distinct skill set. So, having that conversation, reading some resources, if somebody’s listening to my podcast, if they’ve read our sales course, and then codifying that in the software, I think that’s a value. Same thing with building out the systems in the software.

Jordan Muela:

But I think most of it for me comes down to the orientation of the brand and the conversation that we’re having. I’d like to say that that’s the biggest impact we’re making. And I don’t say that to diminish product.

Jordan Muela:

I just know as a software guy, and Ethan, I think you can relate to this, that saying that we have more features than Salesforce, I guess it’s not really interesting to me. There’s a lot of different software’s that you can use to get the job done. But it’s the orientation of the entrepreneur wielding the software that determines the quality of the outcomes, derivative of the software.

Ethan Lieber:

I found too that, whether if it’s a software, you can stick to features. But features don’t tell the user or the customer where things are heading. That’s a brand choice. And it’s probably the same for a property manager. You can tell an investor, accidental landlord if you work with them, about all the features your company offers, but that’s not exciting.

Ethan Lieber:

What’s going to excite them is understanding more about the deeper direction you’re heading as a management firm. You said what energizes you why do you even do this. I do want to ask a question about the unit economics thing you talked about as a competitive advantage.

Ethan Lieber:

But before I do that, I am curious. You personally, Jordan, what drives you to wake up every morning to work on LeadSimple? What’s the internal thing that’s exciting you and driving you and that… I mean, I don’t want to say mission because it just feels contrived, talk about mission as part of the brand. But in this case, I think it works. What is the mission there that’s exciting you?

Jordan Muela:

We want to help people achieve more than they ever thought possible. Really high level, that’s what it is. It’s aspirational. It’s fluffy. But I think in practice, connected outcomes for me, it looks like attacking hard problems that I’m confident are winnable, solvable problems.

Jordan Muela:

There are some unsolvable problems. I don’t want to get hooked by those just because they’re hard. And what that does for me is it ensures that I’m working on something of relevance, and that’s going to call a lot out of me, and that the return will be significant.

Jordan Muela:

And there’s the possibility of failure. And the thrill of the possibility of failure, that gets me out of bed particularly when it’s tied to a big outcome. But holistically, man, I just want to work on making people’s lives better and helping them dream bigger than where they were at before they met me.

Ethan Lieber:

Awesome. So, help people dream bigger, get bigger to do it. We’ve talked a little bit about having that competitive edge that drive the advantage you get from platforms like LeadSimple.

Ethan Lieber:

You talked about how your customers, the competitive edge they have is unit economics. And when I hear that, what I’m thinking, and tell me if I’m wrong, is there’s the operational unit economics and the sales unit economics. And the sales unit economics has something to do with how much does it cost me to get a unit? When do I make my money back on that unit? Is that efficient?

Ethan Lieber:

In operational unit economics, you’re like, “How much money am I spending to run my service? And how much money am I making from the service? I now have a profit margin so to speak, or gross profit margin.” In that vein, I’m wondering are there certain KPIs or metrics that are vital for property managers to track to measure their success? And maybe how does LeadSimple facilitate tracking those?

Jordan Muela:

Sure, let’s start on the growth side. You always have to understand the qualitative and the quantitative. The quantitative, maybe just raw volume. You want to add 300 doors, have a churn rate. You want to add a hundred doors this year. You already have a hundred doors. You know you have an annual churn rate of 20%.

Jordan Muela:

So therefore, you need 120 doors to actually get to that 200 mark. 120 doors, where is that going to come from? Divided by 12, that’s 10 doors per unit on a monthly basis. That’s your benchmark, so having something you’re hitting for and benchmarking against that.

Jordan Muela:

But then on a monthly basis, the qualitative side would be your conversion rate. Your conversion rate is really important because it’s going to determine your cost per lead, and ultimately your customer acquisition costs.

Jordan Muela:

Let’s say you’re average PM, where you don’t have the operational functions of sales and marketing really built out. Maybe you have a BDM, but you’re relying on paid channels for doing marketing. You’re doing a bit of Pay Per Click. Maybe you’re doing some mailers, a host of different things, where you’re going to live or die based on the yield of these leads.

Jordan Muela:

And your cost per lead, which is derivative of your overall marketing spend, plus your conversion rate, that is going to determine what spaces you can play in. There are some folks that can engage in higher volume and more expensive channels because they have a really high conversion rate. So, they’re able to compress their cost per lead.

Jordan Muela:

All of those kinds of considerations, let’s roll it up to customer acquisition costs, which your customer acquisition cost, what you can afford to spend, is a function of your customer lifetime profit, right? You can’t spend a thousand dollars as a customer acquisition costs if your customer lifetime profit is $999. All of that stuff frames how we think about sales and marketing, SEO, Pay Per Click, blah, blah, blah.

Jordan Muela:

I really am not interested in talking about any of that if we don’t have some basic parameters to box in and measure the scope of the broad conversation. Once those parameters are in place, yeah, let’s talk channel strategies. But if we go straight to channel strategies, it’s a fool’s errand. I’ve seen so much heartbreak in that area. That’s on the sales and marketing side.

Ethan Lieber:

Before we get to the upside, which is going to be about onboarding, long-term retention, all that stuff, when your customers come to you… and I know you go through some consultative efforts with them before just throwing them on your platform because I’m sure everyone would come in confused and drowning from some of the complexity maybe. But I’m wondering how many of your customers already know these data points before they come to you?

Jordan Muela:

Bottom-up point, it’s something below one percent, maybe 0.25%.

Ethan Lieber:

So, for anyone listening to this, whose eyes are rolling to the back of their head thinking, “What did I just get myself into?”, they’re not alone?

Jordan Muela:

Absolutely. I can think of one person, maybe two people in my career, Ethan, that had this information freely available the first time that I met them. And I’m talking fast, and it sounds like a lot. But if we slow down the conversation, your customer acquisition cost is everything that you spent in terms of labor and advertising, divided by the number of customers that you’ve got.

Jordan Muela:

Your customer acquisition costs cannot be higher than your customer lifetime profit. That’s the absolute worst-case scenario. And realistically, your customer acquisition cost is something you want to compress as low as possible.

Jordan Muela:

So, if you took nothing else from this podcast, other than measuring your customer acquisition costs on a per channel basis and you graded all marketing and advertising spend based on what the cost was for the deals that came from that channel, you’d have a huge leg up over most of the industries. So, maybe that’s one very practical takeaway.

Ethan Lieber:

I don’t want to go too deep into this, so I’ll just ask one specific question. And then, we can move on to the more obscene at economics. Is there a good ratio of, “Here’s what my acquisition costs should be compared to my lifetime value from a customer.”? How much money I’ll make from them before they might leave?

Jordan Muela:

The best ratio that I can offer here, the best ratios in general, I would say come from SAS. And that’s just because SAS has taken the time to actually look at these things. So, I would say, excuse me, if your customer acquisition cost is one-fifth of your customer lifetime revenue, you’re probably within the realm of reason. I’d say, in general, something below a thousand, but again, you really got to measure your customer lifetime profit.

Jordan Muela:

Maybe let’s settle on this. And this is something I think you can appreciate. Your time to pay back determines when you spend a dollar on advertising. And it results in you getting a customer. At some point, that customer will kick off enough profit for you to get your dollar back to be redeployed to reload the cannon, per se.

Jordan Muela:

So, time to pay back probably has the most dramatic implications of your ability to recycle the money to grow. And if you can’t recycle the money, then you have to take on funding or debt or something from outside the organization to keep growing. So, time to pay back, timeframe of less than 12 months, is probably the thing that I would be watching as the most practical consideration.

Ethan Lieber:

That makes sense. That’s a good way to describe it. Are you familiar with… yeah, I’m sure you’re familiar with Renters Warehouse. I don’t know.

Jordan Muela:

He was one of the two people I mentioned. Brenton Hayden who started it were the two people that knew his customer acquisition costs down to the penny and blew my mind.

Ethan Lieber:

So, I don’t know. I didn’t talk to Brenton. I talked to someone else at Renters Warehouse a long time ago. And if memory serves me right, I think their payback period was 16 months. I don’t know if that rings a bell for you. And I don’t know if that’s typical. Or maybe they were working on it. Maybe that’s why they came to you.

Jordan Muela:

So, the franchisors and franchisees, they don’t franchise anymore, but they used to. I don’t know which side of that you were talking to. But time to pay back is so important because if your time to pay back is in excess of a year or less than a year, it just directly impacts the amount of cash that you have to have on hand to gain the customers that you want.

Jordan Muela:

And time to pay back in my world is a function of a gross profit. The gross profit is what you have to use to actually repay the money that you initially spent. So, if anybody wants more on that, feel free to send me an email. You can Google it. But I find it’s a really practical consideration.

Ethan Lieber:

This is maybe a good segue because if you’re more efficient with the operation, your margin is higher, you make more profit per unit. And without getting more efficient on the sales side, you can actually get a faster payback period simply by being more efficient on the cost of goods sold side because your gross margin is higher, right?

Jordan Muela:

Yes. I mean, weird segue, you are absolutely right. You can hold your sales and marketing efficiency constant. You can improve your net operating income, and therefore get more efficient, boosting the return time on your dollars.

Jordan Muela:

Profit improves everything. So, it’s absolutely something that I feel fine being dogmatic about because door count just isn’t enough. We’ve been talking door count, door count, door count. But door count doesn’t improve your quality of life. It doesn’t improve the quality of the service you’re able to provide. Profit is a broadly cross-cutting consideration that try to make everything better.

Ethan Lieber:

What are some of the success stories you have from your customers that change that profit margin or just amplify their profit?

Jordan Muela:

Well, I’d say that I have the most direct access. And I’m topically most focused on profit within the context of the work that we do at ProfitCoach, where we’re in people’s books. We’re doing coaching based on the P&L. I think the biggest swing we ever saw is probably around, not basis points, 60 absolute points. In that case, that was going from a meaningful negative value to a positive value.

Jordan Muela:

But in general, the life cycle working with a client over two to three years is a swing of somewhere within the range of 20 to 30 points of profit, which is just a life-changing outcome. And it happens slowly. The chart I’d love to see is, in 30 days, everything’s things better.

Jordan Muela:

Now the reality is, slowly but surely, rarely do we meet people that’s like, “Absolutely, I’m firing everybody. I’m going to roll out a new PMA and a new lease in the next 30 days”. People are slow. They want to take their time. They care about their staff. So, it’s a point or two every month and a slow march to where they want to get, but it is holistic.

Jordan Muela:

In the order of the consideration, we start by talking about revenue. Revenue makes everything better. So, your unit economics and taking your revenue per unit on average is 164. We want to get north of 200.

Jordan Muela:

Next would be costs, your labor costs. Your labor cost is the most correlative thing that we saw to profit when we did the NARPM and accounting standards. There were a lot of things that we thought would correlate. That was the only thing just beautifully correlated was labor costs. So, getting that down from on average staff.

Ethan Lieber:

Staff’s going to be the biggest expense and the biggest driver of your costs.

Jordan Muela:

Yeah, absolutely. Well, it’s biggest driver of profit. It’s the biggest cost line item, but it’s the biggest driver of profit. We have that conversation in terms of labor efficiency, which means W-2 contractor, whatever, it all rolls up to the same thing.

Jordan Muela:

Most folks don’t have a benchmark, how many staff should they have, or conversations like, “How about this meeting? How many properties should my property manager manage?” I’ve been doing this a long time. I’ve worked really hard at questions like that. And the answer is, I don’t know. I have no clue.

Jordan Muela:

But I can give you context on labor efficiency, which relates to the overall percentage of top line that should be spent on labor. And when you work within the confines of caps. Think of it as a salary cap. It’s like NFL salary cap. When you work within those kinds of parameters, you get creative. You press back into the story of trying to solve everything by adding, throwing additional bodies in it. And so, it’s a really proactive conversation.

Ethan Lieber:

Is there a good ratio, or a rule of thumb for how many dollars should I spend on labor for every dollar in revenue?

Jordan Muela:

Yeah. So, we’re looking at direct labor efficiency, which is effectively a measure of how many dollars of top line revenue is being kicked off for every labor that we’re deploying on staff. And we’re looking for a DLER of 2.0 or greater.

Ethan Lieber:

Does that mean, for every dollar I spend on staff, I should be at $2 or greater in revenue?

Jordan Muela:

Correct.

Ethan Lieber:

Okay. Interesting. Well, I would encourage then anyone listening to go check your numbers. And if your sub two dollars, I imagine they should definitely be scheduled a call with you.

Jordan Muela:

Yeah, for sure. I mean, I’m happy to chat informally. ProfitCoach actually does that coaching work. I mean, that’s really a floor. We’ve seen folks push it a lot higher than that. But as a starting point, it’s a floor. There’s a whole world of conversation that we had around the P&L in the finance function of the business.

Jordan Muela:

And I think if people are going to take anything away, I would say, just bear in mind, it’s great to have awesome service quality, but the thing that’s going to correlate the most to financial and quality of life outcomes for you is to pay attention to the financial model of your business.

Jordan Muela:

If you don’t understand that, if you’re intimidated by it, I’m here to encourage you and tell you, it’s not a black box. It’s not some fancy science. It’s time. It’s effort and its intentionality.

Jordan Muela:

I had a good friend of mine. One time, I brought him a challenging, perplexing question. And he asked me this question. He’s like, “Well, have you spent any time thinking about it?” And it blew my mind because, Ethan, I hadn’t. I was being avoiding with it. The question, it felt like too much, too complex.

Jordan Muela:

And so, I’m trying to offload, ask my friend his opinion. And his feedback was, “You’re pretty smart guy. How about you take six or eight hours and just focus on it?” The financial modeling, that’s that. It’s astronomically, disproportionately more rewarding than you focusing on just about anywhere else in the business, second only to maybe leadership, but it tends to get elected.

Ethan Lieber:

I want to pinpoint on something that I’m really curious about, and I think listeners will be. They might not. So, if anyone listening isn’t interested in this, I apologize. But I have to ask you because I’m really interested. You just made a comment about service quality and how that interplays with the labor costs and creating profitability and efficiency. I am curious, is there a correlation of service quality to investors and the residents in relation to profitability?

Jordan Muela:

I think the way to frame that is that, in general, the more rework that you’re doing, in general, the more weight, the more perception of waste on behalf of your clients, the more sensitivity there is that either you’re not doing your job, or you are doing your job.

Jordan Muela:

And your job is to squeeze them for as much money as possible. People are aware, have been sensitive of these costs. And so, getting ahead of those costs, doing preventative maintenance, I think it’s a really, really big deal.

Jordan Muela:

But the thing I wanted to say, Ethan, with you in particular that comes to mind for me is, when you think about these different functions of the business and a second ago, I’m like, “Hey, you should be focused on finance. Why aren’t you?”, cognitive bandwidth is the second scarcest resource in any organization. It’s the most precious finite resource, my ability to think, dedicated thinking time.

Jordan Muela:

The only thing that is more scarce than that is emotional bandwidth. Most of us can only afford to have one bad thing happen per day before we’re tapped out, we’re fried.

Jordan Muela:

So, when you’re thinking about optimizing your business, streamlining and finding way to put distance between you and the things that are peak stress, the stuff that just mushrooms, there’s massive, massive value in that. I found for me, solving for those emotional pain points in the business is also hugely rewarding.

Ethan Lieber:

And if an entrepreneur is feeling better, he can have more focus. The business itself is going to do better. The unseen thing [crosstalk 00:40:41]. It’s an unseen thing in the P&L, right?

Ethan Lieber:

You can look at all the output from the financial numbers, but that doesn’t tell you how burnt out owners going to be because… I mean, the business owner, or the entrepreneur doesn’t tell you how burnt out they might be from just things that break, even if the P&L looks good.

Jordan Muela:

Absolutely. It’s the reason why, when you’re looking at your client list, you’re at that point where you need to reset 2, 300 doors, 7, 800 doors. And you’re stacking your clients based on what you’re making per client. You can do that by yourself. You then have to relay with your staff, “Point to me the people that are most difficult. Rank by just raw difficultness.”

Jordan Muela:

It’s not volume of tickets. It’s who screams at you. Who is condescending? Who is abusive to you? Get rid of those people. And it doesn’t matter what you’re making. It’s just that that stuff is toxic. And it has an exponentially disproportionate tax on your ability to think and operate that just can’t be put in a spreadsheet.

Ethan Lieber:

I mean, you’re looking at hundreds of management companies all the time, data on so many different management companies. And you’re seeing the trends in the industry. I know profit margin on average across management companies used to be around 6%. I’m wondering, two-part question, is that increasing? Or maybe that’s still the average?

Ethan Lieber:

And for the ones that do significantly better, are you seeing commonalities in policies they implement, softwares they implement, or certain trends in the way they handle their business that are making them more profitable?

Jordan Muela:

Man, that’s a really great question. I would say two things happen. That six percent number for me came from the original NARPM accounting standard benchmarking study that we did. And a weird thing happened. There’s something called the Hartford Law, which is to say that KPI is worthless once it’s established because people will game for it.

Jordan Muela:

And what that means for me is that our sample set has actually become fairly polluted because we’ve actively coached these people. So, the sample set that I’m looking at is disproportionately worked. I wish the entire industry looked like that, but I’m pretty sure it doesn’t.

Jordan Muela:

We’re looking to do an update on the NARPM accounting standards. And that hopefully will give us access to a better cross section of the industry as a whole. But I don’t know if the six percent is moved or not.

Ethan Lieber:

Why game it? Why hack it? What does an entrepreneur get out of that?

Jordan Muela:

Well, when I say game it, I just mean any metric that you’re now observing that you weren’t before, there’s the phenomenon of extra attention being paid to it, to the degree that it generates some unnatural outcomes. But of course, everybody should be focused. I think the common pattern and answer would be less on how you run your business.

Jordan Muela:

I was just with a million-dollar club, one of the mastermind groups that I host for ProfitCoach recently. And the common patterns for me were around thinking accountability. They blame themselves. They’re quick to act on staff considerations. They don’t put up with…

Jordan Muela:

They’re less frequent to compromise their values. And they realize that it’s only complex when you compromise. That’s a quote from my friend, Steve Welty. I think it’s leadership stuff that is more in common than any of the specifics of how they run their business, even though… yeah, the underlying economic profile.

Jordan Muela:

They know their DLER number. They understand their growth model. They have a forecast. They have a forecast. I can say that 10 times. They know where they’re headed financially.

Jordan Muela:

There’s some stuff in common, but a lot of it really is just the thinking of being a winner, which is you invest in yourself. And you view the gray matter between your ears as the most determinative outcome as opposed to this external stuff outside of you.

Jordan Muela:

The people who need coaching and help and advice the most have the least patience and budget and openness to that. The people that seemingly need it the least, they over index on self-improvement, self-development and outside help.

Ethan Lieber:

I mean, we can explore the inverse of that question which is, it doesn’t matter how smart you are, how amazing LeadSimple is, how amazing ProfitCoach is. Folks will come in that you just can’t help no matter what. What are the habits or red flags and mindset that you would caution listeners, like, “Hey, if you’re seeing this in you or your staff, that’s something you got to work on.”?

Jordan Muela:

I’d say a lack of consideration. When you hear things you disagree with, the cheap answer is to say I disagree. But certainty is the opposite of wonder and curiosity. So, one common characteristic of the less successful is they have a degree of certainty that is unearned.

Jordan Muela:

It’s more connected to their identity and their narrative rather than the rigor that they’ve done to analyze and come to well-trodden conclusions. They jumped to certainty about whether, we can’t do it this way, this can’t change. They’re self-justifying and self-affirming the results that they say that they don’t want. And so, they keep earning them over and over again.

Ethan Lieber:

I think you’re always hearing these opposing sides of these entrepreneurship tropes. You’ve got this like what you just said, right? Not that what you just said is [crosstalk 00:46:32].

Jordan Muela:

Totally. I’m with you.

Ethan Lieber:

The flip side, though, is go with your gut. And entrepreneurs hear this all the time. You got to go with your gut. But what if your gut is saying no, that’s not right, even though you haven’t earned the right to say no, that’s not right? How do you balance that? Do you have any thoughts on that?

Jordan Muela:

I don’t know what you’re looking for there, but I would say I do believe in boundering yourself. I do have appreciation for the work of people like Brené Brown. And I do think that your gut does matter, but I think you should also take in consideration of the results that your gut has produced thus far.

Jordan Muela:

I would say I operate partly on gut, but also on values. Your values are the fundamental thing you don’t want to compromise. If something feels wrong to you, then that’s the time to say no. But if somebody is making a suggestion about finances, or that if you roll out a new PMA, this percentage of people are going to cancel versus not, with that stuff, you got to stay pretty, pretty open and loose.

Ethan Lieber:

Yeah, that makes sense. I like that distinction of tying the gut to what’s value driven, what’s ethics driven, what feels right or wrong with your conscious versus with something that’s more or less you could burn down with a quick experiment. Figure out if it’s right or wrong, that makes a lot of sense to me.

Jordan Muela:

Amen.

Ethan Lieber:

Okay, so moving on here. And we only got a few minutes left. So, we’ll head in to wrap up in a little bit here. Are there any cutting-edge trends that you’re seeing happening that just a few property managers are starting to latch on to now that you think would be good?

Ethan Lieber:

Maybe not to jump on the bandwagon quite yet, maybe they’re too early, or maybe they’re not, but things that most managers haven’t looked at yet. They’re maybe not implementing yet, but they should at least be paying attention to.

Jordan Muela:

For me, that looks like design system thinking. What I mentioned way back earlier in the interview about folks having somebody in their organization on their job description, not as an add on, not in the evenings and weekends, but their job, is to define how work should flow through the organization at a systems level that is fundamentally technology agnostic.

Jordan Muela:

And then, making sure that person has the skills, the oversight, the accountability, and the authority to push that perspective that aligns with the values of the organization. Make sure that stuff is codified and the organization is following through on that.

Jordan Muela:

A lot of owners get enamored. They go to a conference. They get excited about technology as a very broad concept, but they don’t have the skills to push outcomes into the organization. It’s a new skill set in the same way that sales and marketing was a distinct skill set. It’s a new skill set that needs to be cultivated, rewarded and pushed into the organization.

Ethan Lieber:

Is this something the owner of the business should be doing? Is this a new role that business owners should be looking to bring into their companies or something else?

Jordan Muela:

If you’re the owner that wants to do it and has the ability, that’s great. What’s a turn off for me is when somebody says, “Look at my amazing system.”, and they don’t give full disclosure that maybe it took four years and a million dollars to build. If you are that guy or gal that just loves that stuff, that’s great. But you don’t have to be that.

Jordan Muela:

Well, you have to be the person that when your car breaks down, you go to the mechanic and they tell you, you need to transmission, you have to be able to audit and push back in some way, which is challenging, right? I don’t know if I need a transmission. Maybe I can get a second opinion. But there are ways to know enough to be able to ask the right questions. And in this case, employ your own mechanic to be able to get insight into what you’re being told.

Jordan Muela:

But I think in general, this is a distinct role within the organization that is either a reapportionment of an existing leadership role, where you give them a bigger percentage of their job description to focus on this, or it’s somebody that has a distinct role within the organization.

Ethan Lieber:

There’s a customer mutual customer now of LeadSimple and Latchel that I want to give a shout out to. You might know them. They’re an RPM Valley Wide, Keith with his team members. Jesus is literally in the process right now. So, he’s a team member that Keith hired. Keith and his wife run the company. And Jesus is sitting there as this champion for a lot of the process build and system building.

Ethan Lieber:

And they just implemented LeadSimple. And they’ve been working on LeadSimple. So, they didn’t just start with you guys, but they follow that model that you’re talking about.

Jordan Muela:

And it’s common to have RPM’s remote team members in this role. It’s just a different way of thinking, but it’s the future. And the big cutting-edge organizations that I know, they’re absolutely are making this investment.

Ethan Lieber:

And I know LeadSimple is innovating a lot to stay ahead of this trend and provide the capacity and capability to do really interesting things, system wise, process wise to keep companies in good condition with more automation, higher labor efficiency, all feeding back to the metrics you track in ProfitCoach. Can you give us a highlight, teaser, into some of the innovations you’re doing at LeadSimple?

Jordan Muela:

I would say that the main thing to point out here is that innovation stemmed from the fact that we are hell bent on this one-use case. You’re a software guy, Ethan. You’ll appreciate this somewhat technical distinction between the objects that you build in software.

Jordan Muela:

Objects are just to say you can have a dumb field that has a label that says property, or you can have a smart field that was fundamentally built from the ground up to account for the fact that there is a property and the property has doors. It could be multifamily, or single family. It could be HOA.

Jordan Muela:

All of the affordances within our technology are 100% focused on single family residential property management. And it can be fit over for multifamily, et cetera. But the practical implications of that are things like, we import data from all the major property management software vendors, and we’re slowly rolling out native integrations.

Jordan Muela:

But even without a native integration, we automatically suck up all the reports. We make meaning out of them. You can use that to kick off processes inside of LeadSimple. And the way that the interface is built is designed to accommodate a very specific set of processes that are entirely around residential property management.

Ethan Lieber:

That’s awesome. And I think there’s a lot of value when you’re very focused on the use case. Multifamily and single family, a lot of platforms can work for both, but they’re distinct enough. At least high-rise is so distinct from a scattered site environment, where you might not have maintenance on the site, you don’t have management or leasing on site. You’re doing everything in a true fashion.

Ethan Lieber:

It is a lot more operationally complex. In some cases, you have property managers running parts of this. Then in some cases, you’re centralizing certain components, totally different models. And I think focusing on that’s really smart.

Jordan Muela:

Yeah, there’s just one other thing I would add to that one. I’d be remiss not to mention, that in addition to the way the tech is built… I answered it on that level, but the other side of it is it’s just the default, right? There are default workflows. There are default templates. And then, there are people who will help you do a lot of handhold, as much hand holding as you want to build out and customize those things to your business.

Jordan Muela:

So, you’ll never run into a situation where you have a use case of how you want to use workflow for your property management business that we have not already run into and generate a solution for it and can give you feedback on the utility of asking that question in the first place. That’s a huge reason why people use us versus other off the shelf industry agnostic software.

Ethan Lieber:

I want to touch base on something really quick before we wrap up, because you’ve alluded to this a couple of times in this conversation. And it’s something I hear a lot from managers. You talked about having people on the team that are implementing systems and finding the right systems and the way these things will work together.

Ethan Lieber:

You’ve mentioned you have easy ways to import data from a PMS in the LeadSimple. You’re starting to look at native integrations. I see a lot of hesitancies, particularly from companies that are starting to grow that might not have a lot of labor bandwidth, hesitations around using multiple platforms.

Ethan Lieber:

And I won’t make a comment on the value of integrations or not having integrations, but I do want to hear from you, is it a valid thing to worry about integrating everything, so it’s all accessible from my AppFolio, or my Propertyware, my manager versus the potential value of having different platforms that are going to be more specialized for different types of work? Do you have any thoughts on that?

Jordan Muela:

I think it’s an entirely legitimate question. And in a perfect world, everything would be built in one system, and you’d be retinal scanned every time you sit down to your computer to use it. It’d be that easy and integrated. The reality is, you get benefit from discrete systems in proportion to the importance of the use case and the depth of the solve for a point solution.

Jordan Muela:

If I’m going to embrace a point solution out of my main tech, they better be a use case that matters, and they better have a deep solve. The reality is, your PMS knows and understands that in software, they say, “Bitchin’ isn’t switching.” You can complain all day long, but the reality is you aren’t important enough because we have your data.

Jordan Muela:

And therefore, when we make an add-on, it doesn’t need to be… if I make a leasing add-on, it doesn’t need to be as good as Tenant Turner. Seventy percent is good. And guess what? You’re going to stay. So then, you have to make a decision. How important is this use case, where I’m thinking about new software, and how deep and unique is the solve? And I think that’s what determines these things.

Jordan Muela:

But in general, one trend I see is there are more and more companies that are stripping back what their PMS does to get as close to accounting only. And they’re building the heart of their ecosystem in other places where they own control, can manipulate and bridge the data for maximal flexibility. Will that be the future? I think that’s in some ways up to the PMSs in terms of how much they choose to open up.

Ethan Lieber:

I think if they don’t open up, they’ll all lose to whatever systems. “Okay, we’ll just do accounting and we’re open.”

Jordan Muela:

The free market view on monopolies is that they can’t be maintained because somebody will always break the complicitude. One of those vendors is going to push an open data paradigm and the rest will eventually follow suit.

Ethan Lieber:

Yeah, totally agree with that. Well, we’ve only got a couple minutes left and I want to make sure people know how to get in touch with you, how to find you, how to learn more about LeadSimple and ProfitCoach. So, maybe you can tell us, how do we find you? Do you have a cell phone number for us? What’s your preferred-

Jordan Muela:

Shoot me at an email, jordan@leadsimple.com. That’s the best way to get in touch with me. Oddly enough, I actually use WhatsApp a ton. So, if you shoot me an email, I get connected with people on WhatsApp. But that’s the best way to get in touch. Check out profitablepropertymanagement.com. I do biweekly podcasts. And also, I have a newsletter attached to that.

Ethan Lieber:

Awesome. Jordan, thanks so much for joining. I know we’ve been trying to set this up for a while. It was an awesome conversation. We went super deep on some things that I think are going to be really valuable for listeners. We went a little bit philosophical on some things. Awesome conversation. Thanks so much for joining. It was great to have you here.

Jordan Muela:

Hey, man, I enjoyed it. Thank you for adding value and taking the time to do these kinds of interviews.

Ethan Lieber:

I love doing it especially with a very smart, interesting folks like you. So, we’d love to have you back in a few months for more updates on LeadSimple and ProfitCoach as they come around.

Jordan Muela:

Let’s do it, man.

Ethan Lieber:

And for everyone that tuned in, thank you so much for joining. We do this for you. So, if you want other news on property management growth, scalability, things like that, head to latchel.com, subscribe to our newsletter to stay up to date. We post upcoming podcasts there, webinars, and even just tidbits and tactics for growth-focused property managers. Thanks everyone for joining. See you.