What are the latest economic trends affecting the real estate industry? These trends can seriously affect your decisions to invest more or to switch to cash reserves.

6 Economic Trends Every Real Estate Professional Should Know

How well do you know the current economic climate and trends? Do you have the latest data? We do.

1. Housing Prices Are Up 7.1% Over Last Year

The fine Bill McBride at CalculatedRisk compiles incredibly valuable statistics on the housing market and is well ahead of the curve when it comes to the housing market. This data comes from CoreLogic and their most recent data (May). Going forward, they expect a 5.1% increase year over year through next May. Bill notes that this increase has been in the 5% – 7% range over the last 3 years and that year over year price increases has been positive every month since February 2012. That is quite a long run of positive growth. Will it continue? Read on to learn more.

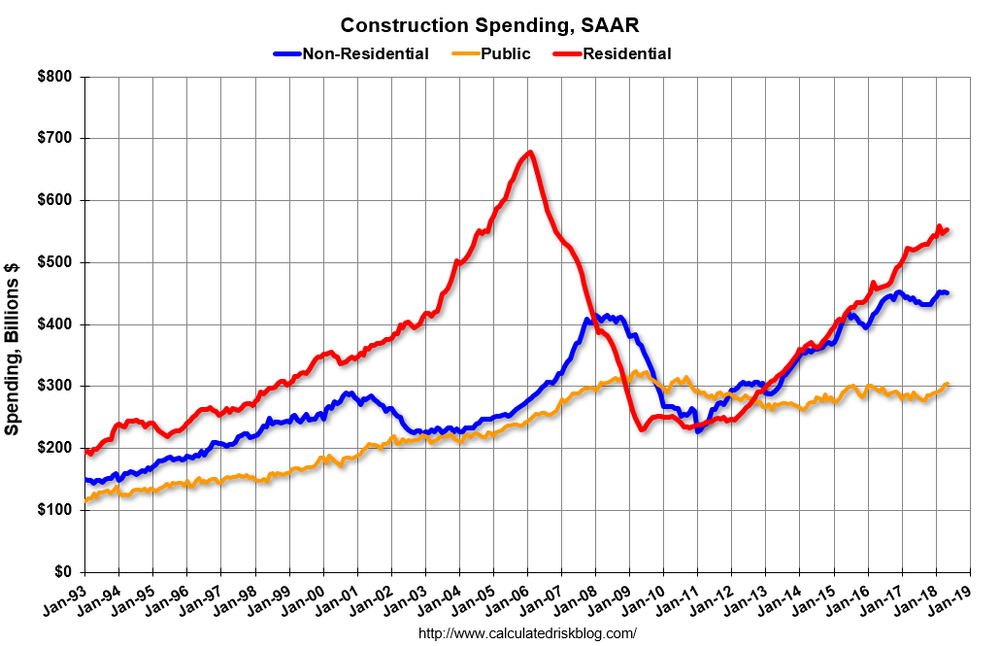

2. Construction Spending Is Up 0.4%

Private residential spending has been increasing steadily, but the growth rate still remains well below the peak during the last housing bubble. Note that the graph below is not inflation adjusted, so there is still quite a bit more growth room available before reaching the previous peak.

3. Housing Construction Material Costs Are Up Sharply — Are These Two Related?

Both spot prices and futures on framing lumber, a critical component of housing construction materials, are up sharply and well above bubble peaks. This is certainly due to tariffs being imposed on lumber, steel, and other materials being imported into the US and will increase construction costs. These costs will slow down the construction industry and potentially less supply will come into the market, which may further motivate housing price increases. The data came from NAHB.

4. Personal Income and Spending Are On The Rise

CalculatedRisk also summarizes information from the Bureau of Economic Analysis. Personal income increased 0.4% in May, and spending increased only 0.2%. This is growth at a good pace, but below economists overall expectations. As a result, estimates for overall economic growth in Q2 are being revised downward. However, overall trends indicate Americans are earning more and more and also spending more and more, so this suggests strong consumer confidence.

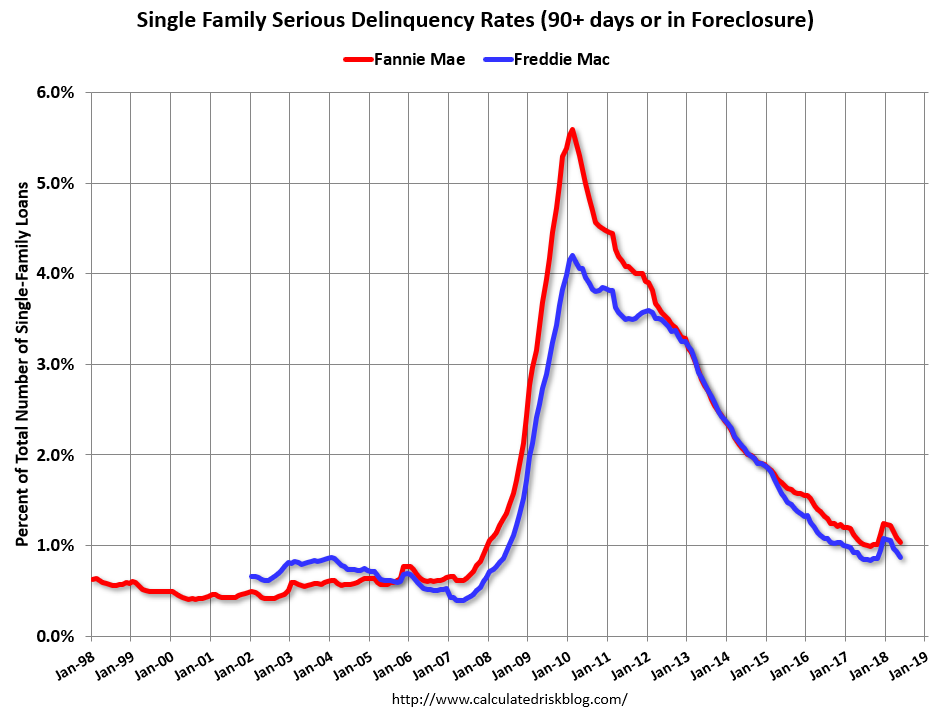

5. Mortgage Delinquency is Still Falling

Yet another summary of data from CalculatedRisk. This time the data comes from FannieMae. Single Family Serious Delinquency (meaning 3 months or more past due or in foreclosure) is down to only 1.03%. The recent uptick was largely due to hurricanes. The downward trend seems like it will continue as long as income is increasing, which the news above, suggests it will!

What will slow down the increase in housing prices?

6. US Inflation Reaches 6-Year High

Inflation rose to 2% in May, which is its highest level since April 2012. Now, 2% is the Federal Reserve’s “inflation target” however, for many years, the Federal Reserve has treated their target more like a cap. Hopefully the Fed doesn’t increase interest rates too quickly, which would quash inflation and also slow down the growth in housing prices. Source: Wall Street Journal.