Banking Deregulation to Pass this Week

Congress repealed most of the Glass-Steagall act in 1999, in part resulting in the deregulation of banking that led to the 2007 subprime mortgage crisis. This week, Congress is expected to repeal the Dodd-Frank regulations meant to control the financial industry from another such collapse. It will mark a victory for the deregulation of banking and will be a move that permits continued growth of the economy via lending across sectors. The big question remains: is this just setting up the US economy for another giant bust in 10 years? What are your thoughts? Do you think banking deregulation is a positive or a negative for the US economy?

See the full story at the WSJ.

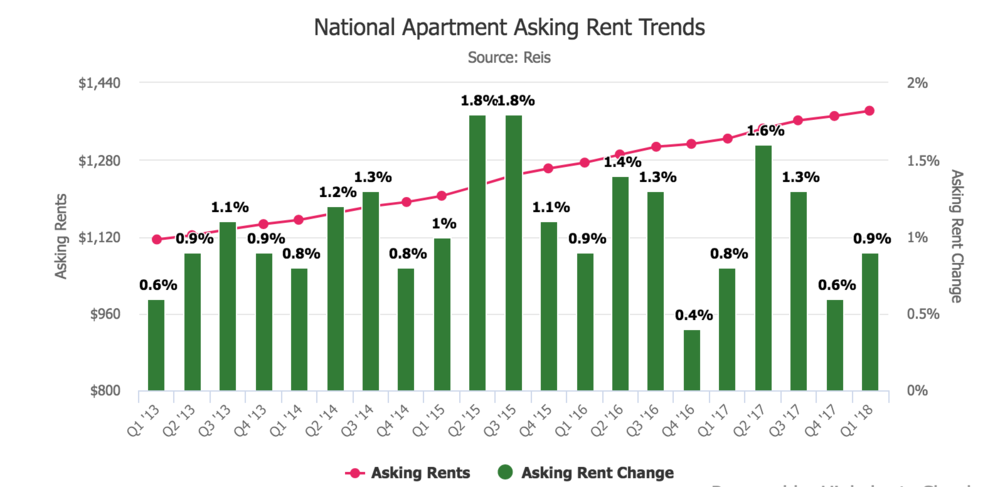

Apartment Supply Outpaces Demand

Apartment landlords are finding it difficult to raise rents as supply has exploded and is outpacing demand in many markets. Should demand waver the pace of new supply could cause rent prices for apartments to dip.

The overall market is still relatively healthy, despite the new supply. Of the apartments in the U.S., 95 percent were occupied at the end of first quarter in 2018. That’s equal to the occupancy rate the year before and down just 10 basis points from the quarter before, thanks to a particularly strong performance in the month of March, according to research firm MPF.

Rents will likely continue growing throughout the year but at a slower rate than they have been. For the full analysis head over to NREI.

Six Takeaways from RECon 2018, Day One

Below are the 6 key takeaways for commercial property managers:

- Tenant mix is more crucial than ever.

- Food halls are not necessary to bring in retail customers.

- International retail chains are expanding.

- Landlords want to own and control their data.

- Hotels are being incorporated into retail sites more often.

- It may be time to sell retail outlets.

With the heat on retail in the last decade, many commercial property managers are opting for less retail and more hotel, industrial, or multi-use property.

Next Economic Recession Scheduled for 2020

(Bloomberg)—Mark your calendar. The next U.S. recession will begin in 2020, a survey says.

More than half of the 105 real estate experts and economists in the quarterly survey by housing data provider Zillow and research firm Pulsenomics LLC point to “monetary policy as the likeliest cause.”

Fed officials have signaled at least three rate increases this year. A year ago. a geopolitical crisis was seen as the most likely cause of the next recession by survey panelists.

In the meantime, the housing market is expected to see stronger price appreciation than forecast a year ago with home values rising 5.5 percent to a median of $220,800 in 2018, according to Zillow and Pulsenomics. Last year, forecasts called for a 3.7 percent gain.

A separate Fannie Mae survey forecasts home prices will rise 3.9 percent over the next 12 months.