How to Use Contractors for Fix and Flips

Mark Ferguson does over 20 flips per year in addition to remodels of rental units. With this much fix and flip activity, he’s always in dire need of good contractors. In this article, he gives a rundown of how he’s successfully used contractors to make a booming business of fix and flips. First, he lays out the groundwork:

- Do not over improve a house for the neighborhood it is in.

- Make a house safe, but try to avoid major remodels and changes.

- Try to make the changes as neutral as possible.

- Constantly look at other houses that are selling to see what needs to be done and what does not need to be done in order to sell.

Once you’ve got a relative handle on the total cost for the flip, he lays out the right way to pay for materials.

- Many contractors will not shop around to get the best price. They will work with whatever supplier they like or whatever is easiest for them. They know the cost is passed on to the consumer, so they are not worried about material prices. There have been many cases where a contractor insisted on using his supplier for materials. I asked them to compare prices with my supplier, and my supplier is almost always cheaper.

- Some contractors will mark up the cost of materials so they can make more money on a job.

- Some contractors will use the cost of materials to get more money up front. Some contractors will require money up front to start a job. Many times, they say they have to have money to pay for materials. Well if I am paying for and picking out materials, they can no longer use that reason to charge more up front.

- I also rarely trust contractors to pick finish materials. Once in a while, we let one pick something out if we are in a bind, and we are usually disappointed with what they choose.

He points out that getting a Home Depot Pro account helps protect you against price markup by contractors because you can permit them to buy off your account and you know you’re getting the normal rate from Home Depot.

He then digs into how he pays contractors:

- Get a bid from my contractor. I sometimes negotiate if the price is not where I think it should be.

- If I approve the bid, I pay 25% up front to contractors I know and trust.

- I pay 25% at the halfway point.

- I pay the rest of the 50% after the house is completely finished. This includes going back to blue-tape things that need to be fixed after the contractor says they are done. If you pay a contractor everything they are owed before the work is done, it can be very tough to get things finished.

- With some contractors who I have used many times, I will pay them weekly for work they do. Before they start, I get a bid for how many weeks it will take them.

- I pay for almost all the materials myself, and their bids are strictly for labor on most jobs.

In regards to finding contractors, he likes to meet in person before starting work, but you must first find the contractor. If you can’t get one via word of mouth, there are certain online resources like Thumbtack, HomeAdvisor, or even Latchel that can help you source contractors for specific parts of the job. For the most cost efficient hiring, you’ll want to go with tradesmen and not a general contractor.

Proximity To Public Transit Less Important For Rental Values

Since the rise of Uber and Lyft, premiums normally commanded by rentals near public transit have disappeared. Current numbers are only for San Francisco, but analysts believe that apartments all over major metropolitans will decrease in rental value if they perviously commanded premiums for public transit proximity.

It is amazing how one industry (ridesharing) has had such huge impacts across other tangential industries like housing. The flip side to this is that rentals out-in-the-boonies may command higher rent prices now that rideshare makes travel more accessible. Check out the rest of the story on NREI.

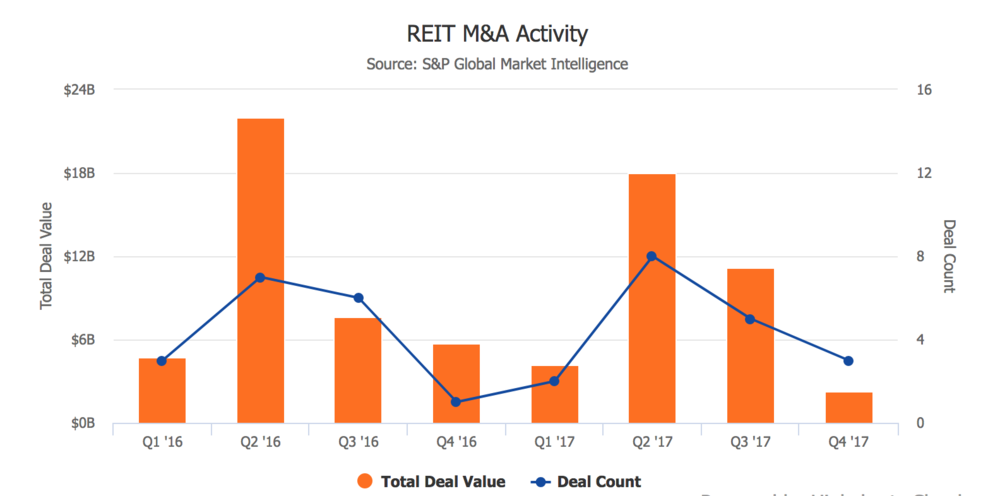

M&A in the REIT Sector

Analysts believe that the macro-economic environment is prime for REITs to accelerate mergers and acquisitions.

With wide belief in the market that the current real estate cycle is in its late stages, interest rates and cap rates are creeping up, and debt is readily available. There’s also a large disconnect between private and public real estate values, several analysts note. “The backdrop is certainly conducive to M&A,” says Haendel St. Juste, REIT analyst at Mizuho Securities USA.

We’ve generally seen pops in activity during Q2 as well.

Interested in seeing what mergers are already on the books? Head over here to find out.

7 Steps to Avoid RE Investing Mistakes

Forbes gives 7 steps to help protect you and your time from killer real estate investing mistakes. Here’s the high level. Click the link above to get the full scoop:

- Always do your due diligence when buying a property no matter how lazy you’re feeling.

- Choose a broader mix of real estate investments so that you’re not all-in on one type or geography.

- Use objective numbers and stats when forecasting growth and income.

- Pool your risk with other RE investors to reduce your own risk.

- Don’t buy into the sunk cost fallacy, know when to cut your losses.

- Be honest about your loser investments because they will inform a winning strategy.

- Stay humble. Like Warren Buffet keep perspective and objective around your investments, you’re always at risk of choosing a loser.

US Home Construction Declines

(Bloomberg)—U.S. new-home construction declined in April as fewer starts of apartment projects outweighed a modest improvement in single-family structures, government figures showed Wednesday.

Highlights of Housing Starts (April)

Residential starts fell 3.7% to a 1.29 mln annualized rate (est. 1.31 mln) after revised 1.34 mln pace in prior month Multifamily home starts slumped 11.3% after a 13.6 percent March increase; single-family rose 0.1% Permits, a proxy for future construction of all types of homes, fell 1.8% to 1.35 mln rate (matching est.) Report included revisions to housing starts dating back to 2013 and building permits to 2012.