Post

Check out our Podcast!

Tune in to get the latest in tools & knowledge from industry experts to run & scale your property management company and real estate investments.

Join our exclusive Latchel community of property managers

Get access to the most recent innovations and news in property management. We’ll send high impact, growth focused information on a weekly basis.

Sure provides tailored renter’s insurance that enables property managers, owners, and residents to protect their property, minimize risk, and experience the peace of mind that comes with the protection of your assets and business.

Most leases require renters insurance. So, we’ve partnered with Sure to provide that option for your residents. While residents aren’t required to use Sure to meet the renter’s insurance requirement, this is still a convenient option you can offer to your tenants.

All services and products are provided by Sure, not Latchel subject to Sure’s terms and conditions.

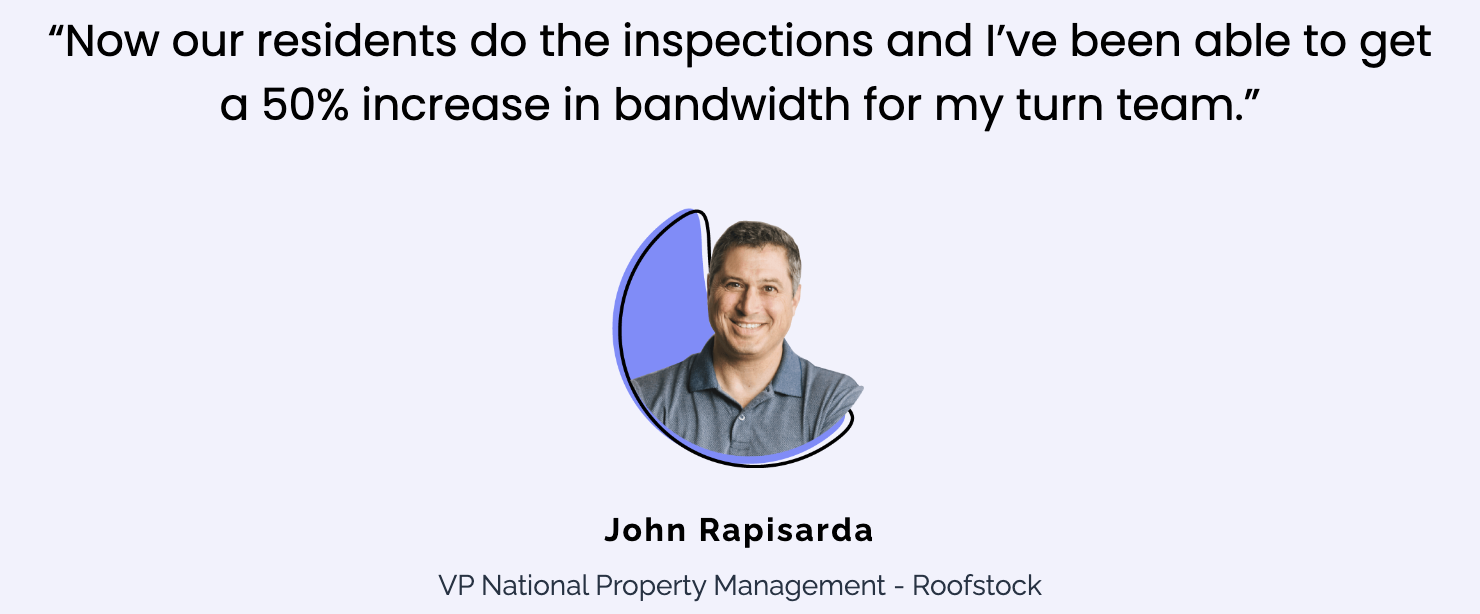

Make Inspections Easier

RentCheck saves time by enabling residents to complete inspections on their own. Customization and automation ensure the job gets done.

Stop Wasting Time

Schedule inspections for all stages of the lease cycle at any cadence you choose. RentCheck handles the reminders.

Instantly Submit Work Orders

Take advantage of Latchel's integration with RentCheck to instantly submit a work order for any maintenance issues that pop up on an inspection.

Modernize Your Process

Easily compare new and existing inspection reports, side-by-side, and avoid security deposit disputes.

Prompt Routine Filter Changes and Resident Tasks

Schedule resident reminders to replace filters and other upkeep tasks over the course of the lease lifecycle.

To learn more about RentCheck, talk with a Latchel benefits expert today. All services and products are provided by RentCheck, not Latchel, and subject to RentCheck’s terms and conditions.

Access world class pest control for a fraction of the normal price. No need for new software or a complicated setup.

Easy Pest Control

Residents simply reach out to Cover Pest if there is a pest issue, and Cover Pest takes it from there.

Clarity on Who Pays the Bill

No more awkward conversations about who is responsible for the bill! With Cover Pest as a resident benefit, residents get pest control for covered pests without an additional cost.

Vendor Sourcing

No more sourcing for vendors! Cover Pest will source and coordinate with vendors for each pest control request

To learn more about Cover Pest, talk to a Latchel benefits specialist today. All services and products are provided by Cover Pest, not Latchel, and subject to Cover Pest’s terms and conditions.

FilterTime is an air filter delivery service that makes it easy and convenient for residents to replace their air filters. FilterTime customers can protect their HVAC system, reduce dust and pollen, save money on energy costs, and more by leveraging this delivery service.

Reduce Labor for HVAC Issues

Filter delivery service results in a 38% reduction of total HVAC ticket requests.

Cost Savings on HVAC Repairs

Average HVAC repair costs have increased by 48.7% year over year. an air filter delivery subscription can cut costs up to $250-300 per property per year.

Energy Reduction

Filter delivery is saving residents $14.82 per month in energy costs.

Choose from almost every size and type of air filter including custom-made sizes

Choose how often you want your filters delivered

A box of brand new air filters delivered to your resident’s front door

To learn more about FilterTime, talk with a Latchel benefits specialist today. All services and products are provided by FilterTime, not Latchel subject to FilterTime’s terms and conditions.

Drive On-Time Rent Payments

Piñata rewards renters for on-time rent payments through Piñata cash, and boosts renter's credit scores for online payments.

Boost Resident Satisfaction

$30 gift card to use at select brands and businesses, $25 restaurant card, 720 annual Piñata Cash to use on rewards, Early lease renewal gift.

Attract and Retain Renters

2 out of 3 renters prefer properties with rent reporting. Plus, residents get incentives for early lease renewals.

Rewards Residents Love

Residents can use Piñata Cash on brands they know and love, such as: Starbucks, Amazon, Sephora, Lego, Target, Walmart, Home Depot, Lowes, Doordash, Best Buy, and many more!

Residents easily earn Piñata Cash any day of the month by doing things like taking surveys, referring friends, or trying out new products.

Residents also get access to big-ticket giveaways, limited drops and super surges!

And, with exclusive access to our marketplace with over 300,000 deals, residents can squirrel away up to $4,500 annually.

To learn more about Piñata, talk with a member of our benefits team today. All services and products are provided by Piñata, not Latchel subject to Piñata’s terms and conditions.

Now you have one less thing to worry about with a Master Liability Policy through Obie.

Affordable Coverage

Affordable policies available with liability coverage starting at $100,000 and up to $300,000 to meet any property manager insurance requirements.

Stay 100% Compliant

Master policy provides $100,000 for management companies and owners by ensuring 100% of occupied homes and units are covered for property damage liability issues relating to resident negligence.

Peace of Mind

Liability coverages include perils such as fire, smoke, water, explosion, overflow of sewer, and many others that provide coverage for damages you (the resident) may cause to your unit or home

Personal Liability

Personal liability coverage is automatically include to protect you against claims where you may be considered legally liable. (Bodily injury claims, dog bite claims, and more)

Additional Coverages

Additional/expanded coverages are also available. (Pet damage, identity fraud, theft/vandalism, and more are available!)

All services and products are provided through Obie and are subject to Obie’s terms and conditions.