The #1 Key to Success According to a Self-Made Real Estate Billionaire

Philip Michael tells the story of meeting with Larry Silverstein, a self-made NYC billionaire and the man that took over the World Trade Center just 6 weeks before 9/11. He recounts the awe inspiring meeting and the secrets to success that he walked away with. One stood out above them all.

Focus.

You need to set your sights on a goal using intelligence, good judgment, and good reasoning with respect to choosing that goal. But once you’ve chosen it, then your focus has to be total. It’s important not to be swayed from it. Set your sights on it, and go for it.

You will face risks and obstacles. You will face naysayers and tribulations. But above all else, you must stay focused on your goal. Know your own markers for progress and let those guide you. Never let external inputs that don’t have bearing on your achievements divert your focus.

The keyword here is determination. He discusses his determination to recover and rebuild after the attacks despite the hardships and obstacles to do so. Larry explains that part of his determination and ability to push through all obstacles was his unwavering integrity. That by having integrity through all of it, he maintains the friendships to carry him to continued success.

Once you blow your name — your reputation — to try to get it back is almost impossible. Because everybody becomes disappointed in you. And as a result of that disappointment, you’re chopped liver. You’ve had it. You’re done!

For the full story head here.

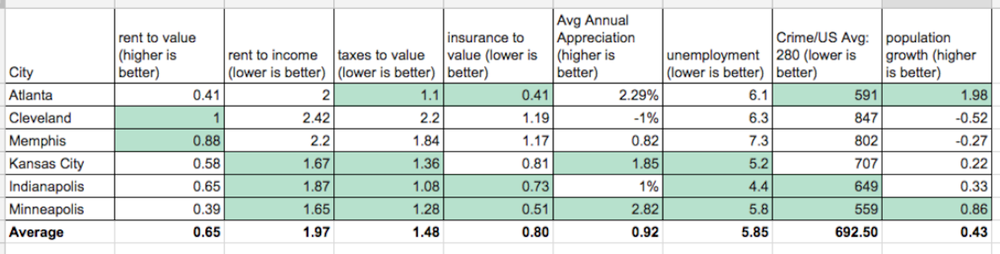

6 Best Cities to Invest

What’s interesting about this chart is the pattern we see in the rent to value column. This is calculated by dividing the median rent by the median house/condo value. So, for Minneapolis, you see that the cost of homes is moving up faster than the cost of rent. On the inverse side, you can command more rent in Cleveland and Memphis compared to the cost of the home.

Get the full analysis.

The Secret to Scaling a Large Property Management Company

Matt Faircloth describes the importance of building and using systems to scale a business. A system does not mean removing people from the equation, rather it means creating processes that people follow to get replicable results every time. Latchel follows the same methodology in our operational processes.

Once the core operation is functioning as a system, you can begin introducing technology to create more scale. Similarly, we use technology to provide more efficient systems for the people that are a part of the property management process.

Read Matt’s full takeaway from Chad at BiggerPockets.

4 Buying Criteria for Rental Property

Ali Boone gives her 4 criteria for buying a rental property:

- Cash Flow: Most important metric is cash-on-cash return.

- Cash Flow Sustainability: What are the risks in a declining market?

- Ideal Cash Flow Amount/Month: All about the cap rate.

- The 50% and 2% Rules: 50% of income goes towards expenses and the projected monthly income is at least 2% of the purchase price.

This is a loaded article and my brief summary does not do it any justice. Read the full breakdown of Ali’s criteria here.