Property Manager Daily Update

SFR Investors Are Building

In order to meet skyrocketing rental demand, investors are building single-family residences. Development increased by more than 6% since last year, totaling more than 36,000 houses for rent in 2017. This is the largest number of “build-to-rent” houses completed in any year for at least the last 14 years.

As investors that come from “fix and flip” backgrounds begin entering this hot SFR development space, there will be a learning curve and a competitive disadvantage to large REITs that have perfected investing in the space. However, REITs will be slow to move on trending markets versus individual investors taking fast action. See the full scoop here.

Real Estate Investments for Passive Income

Let’s talk about passive income and financial freedom. What are passive income and financial freedom? Since I started in real estate, I have bought and held on to a lot of properties that I have not sold to investors. At one time, I had about 25 single family homes in my portfolio that my in-house property management company was managing. Was that passive income or financial freedom?

That portfolio was bringing in way more than the averageU.S. salary, but I’m happy to tell you now that wasn’t true passive income. In my opinion, it also wasn’t true financial freedom. Let me tell you why—because I still got the call. What call? “Umm, your roof just caved in because a tree branch fell off and it broke everything!” Or, “Hey, your tenant’s toilet is clogged and we can’t seem to figure out what’s wrong with it and we’re going to have to get Roto-Rooter out here. It’s going to cost $300.” And so on.

So what is true passive income then? Engelo Rumora believes that real passive income means you never get that phone call. He suggests finding the 4-6% property manager so that you’re not the one at the front line. I suggest looking at Latchel as well. Pass the call off for $26/month instead of a large percentage of your monthly income. See his full article here.

The Epiphany that Gets You 4000+ Doors

Andrew Propst began seeing huge returns in 2010 when homeowners chose to become landlords because the price of home sales was too low to sell. He knew though that the influx of new single family residences into his portfolio wouldn’t last. So he changed his mental model:

We needed to stop looking at where the market was currently and focus on where it was going next. While we still brought on the short-term reluctant landlords, we looked to the future. Knowing the demand would come back with the market and that very little new supply was being added, we saw our opportunity. We went vertical.

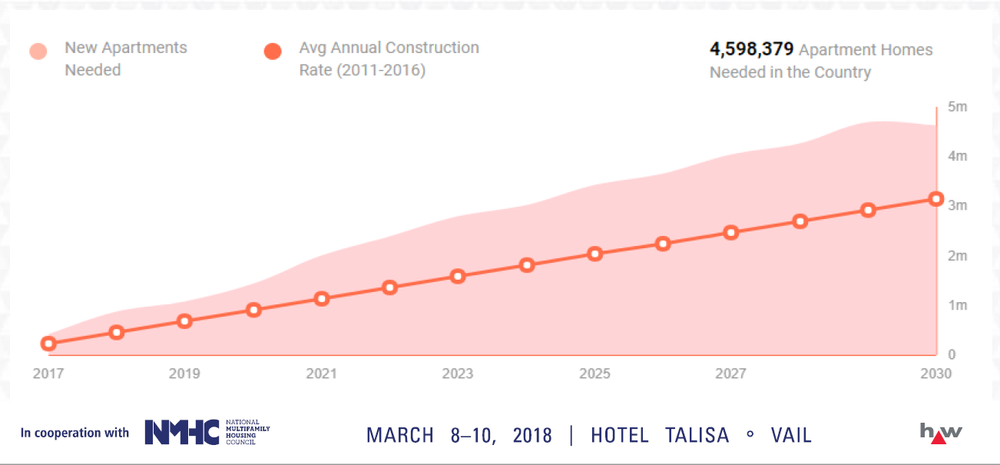

He looked to Multifamily as he knew demand would rise and supply of rentable units would be low.

See how he made the full transition into multifamily building and how he corralled savvy investors to his cause here.

CAA Protects Landlords in 3rd Party Payment Bill

CAA added landlord protections to a recent bill allowing tenants to pay rent through a third party. Many landlords previously denied third party payment because of fears that the third party payer would have claims to the property lease.

AB 2219 now provides that a landlord who accepts a rent payment from a third party can require that the third party sign a document acknowledging that the transaction does not make him or her a tenant.

Are you already accepting third party payments? Let us know if you’re in favor of the new bill.