Wall Street Moves To Nashville?

A wall street firm managing over $550 billion in assets, Alliance Bernstein, announced that it would move its headquarters to Nashville for the tax breaks. A new Tennessee law cuts taxes for publicly traded investment firms. I wonder how many new REITs we’ll see moving to Tennessee?

This could hurt the New York office real estate space in the long run as more offices flee an expensive city for lower cost alternatives.

AllianceBernstein has been consolidating office space to reduce costs. In an October conference call with investors, the firm said it vacated a floor at its Manhattan headquarters to market it for sublease, a move that was expected to save about $3.6 million a year.

Managing Your Property Manager

How do you know that your property manager is delivering high profits and superior care to your rental property? This should be the goal of every property manager, but tracking their results is not so easy. How do you know they’re taking care of maintenance? How do you know you’re paying the right price for service professionals?

Forbes gives us three simple questions to ask our property manager to manage them better.

- How fast did you turn my last vacancy?

- How often do you inspect properties you manage?

- What regular preventative maintenance do you perform?

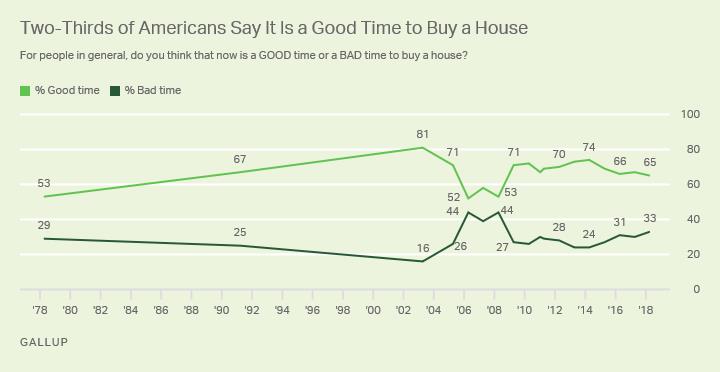

Optimism About Home Buying

2/3 of Americans believe it is a good time to buy a home. We currently have the highest level of optimism about home buying since before the last crash. Is that a bad sign? Not necessarily. Today, out of control subprime mortgage lending is not an issue like in 2006.

Marketwatch points out:

There are signs that the U.S. housing market could be overheating. The number of U.S. homes being flipped—bought and sold within a year—reached an 11-year high last year with more than 200,000 homes being flipped for second consecutive year, according to research firm Attom Data Solutions. Flipping peaked at 334,000 homes in 2005, again just before the market’s peak.

How much should you offer on a property?

You at least have a decent idea of what you should spend on a property. Do you offer that exact amount? Or is it better to go in and lowball the offer to get a better price? Brandon Turner says there isn’t an exact right way to do it, rather, it depends on your purchase strategies.

There are a few things that summarize his feelings on what to do:

- Been on the market a long time? Lowball it!

- Just hit the market and looks attractive? Go with the exact price.

- Not in a rush to buy? Go somewhere in between. Well, this is my feeling at least.

Get the full scoop on offer price here.

Blackstone to Acquire Gramercy Property

(Bloomberg)—Blackstone Group LP agreed to acquire Gramercy Property Trust, which owns industrial real estate in the U.S. and Europe, in a cash deal valued at $7.6 billion. A general shift in online purchasing has boosted demand for warehousing space. Blackstone hopes to capitalize off this acquisition as companies like Amazon continue displacing brick and mortar for large warehouse space.

What does this movement to logistical efficiency ultimately mean for the commercial real estate space? We continue hearing about retail being displaced for warehouse space. How do you think residential space will begin displacing office space as professional work moves to the home? Get the full scoop on Blackstone’s acquisition of Gramercy Property here.